Tag: Fraud

Romance Fraud: Couple tricked victims into sending them hundreds and thousands...

A couple who tricked victims into sending hundreds of thousands of pounds in a romance fraud and...

Unmasking TikTok’s disturbing underbelly’

“Perpetrators often expose women's pictures and overlay them with sexually explicit noises, using these images to blackmail,...

‘Jacko scent’ fraud denied: Batley designer in court over Michael Jackson...

Designer Hrh Arfaq denies all the charges against him

A Yorkshire fashion designer who claimed to own a...

Scams warning for tax credits customers

“Over 1.1 MILLION suspicious referrals recorded in last 12 months”

Tax credits customers should be vigilant and alert...

Fraudulent Claims: Coronavirus loan schemes under scrutiny

In a bid to reduce the devastating impact of the Coronavirus pandemic on UK businesses and in particular to Small to Medium...

MQM leader Altaf Hussain slapped with £2M penalty

The British government has fined Muttahida Qaumi Movement (MQM) leader Altaf Hussain for £2 million over income tax evasion and an investigation...

Athlete wins fight over major supermarket trademark infringement

A High Court ruling found Sainsbury's Supermarkets Ltd, Waitrose Ltd and Scratch Meals Ltd guilty of trademark infringement of a small health-meal...

A stiff fine: Doc having affair admits prescription fraud for free...

A court heard how a married fertility consultant wrote fake prescriptions to get packs of free Viagra to boost his performance in...

Fraudster went on mad shopping spree after conning elderly man

A callous fraudster has been brought before the courts after conning an elderly man out of his bank cards and going on...

Cyber fraud trio jailed

Three fraudsters who used malware to steal tens of thousands of pounds from victims across the country have been sentenced.

Former accountant guilty of £140,000 fraud jailed

A former accountant at a small family-owned firm who fraudulently transferred more than £140,000 worth of payments to her personal account...

English language test scammers have sentences increased

Two men who helped more than 1,000 UK visa applicants to fraudulently pass English language tests will be jailed for longer...

Indian business tycoon to be extradited back to India

The UK Home Secretary Sajid Javid has approved the extradition of Indian business tycoon Vijay Mallya, the Indian multimillionaire chairman of Kingfisher beer and...

Man who defrauded pension fund for over £1m jailed

A man who defrauded a pension fund for over £1m has been sentenced to jail.

Ian Robert Woodall, 47, of Mickleham in Dorset was found...

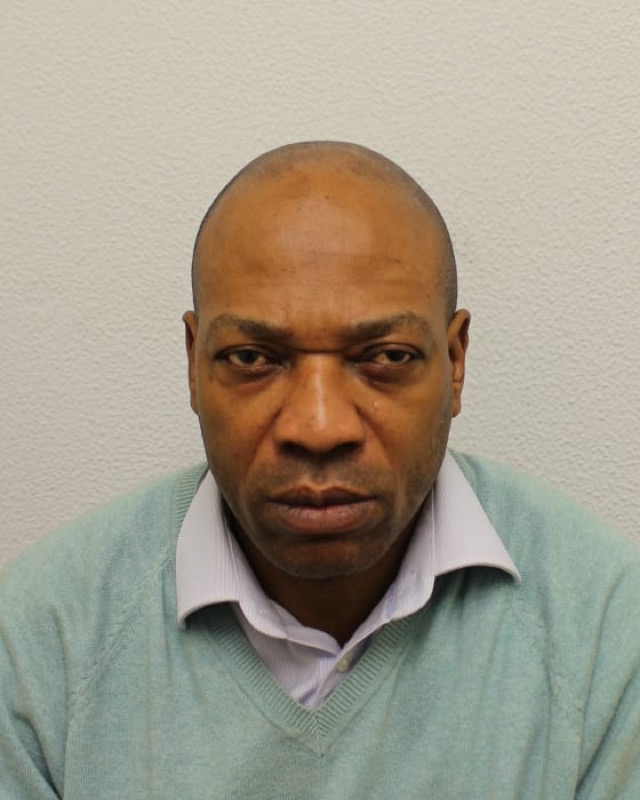

Grenfell Tower: Man convicted of £30,000+ fraud

A man has been convicted of fraud offences after claiming more than £30,000 in accommodation and financial assistance intended for the victims of the...

Alarming rise of criminals using young people as ‘money mules’

UK's fraud prevention service, Cifas, has said that the number of young people caught acting as "money mules" has doubled in the past four...

Police officer Reshat Kemal sentenced for fraud

A police constable has been handed a suspended prison sentence for fraud.

PC Reshat Kemal, aged 35, attached to Hammersmith and Fulham borough, pleaded guilty...

FOOD FRAUD: 37% say takeaways are the least trusted type of...

A new food fraud report shows that almost two thirds of people in the Midlands (64%) regularly take measures to ensure their food is...

Trio sentenced for defrauding the Home Office of EU funds

Three fraudsters have been sentenced for conspiracy to defraud after stealing more than £1.1 million of public money from the Home Office in an...

Woman convicted of romance scam fraud

A woman has been convicted of being part of a romance fraud which tricked seven men into handing over more than £100,000.

Grace Akintaro, 24...